The WAX DEFI system might feel a bit complex at the first glance, it's using two blockchains (WAX & Ethereum). It has a burn mechanisms and to take part of the DEFI model you are required to understand how uniswap works on ETH, as well how you swap tokens from WAX to ETH. But don't worry, the basics are rather straight forward, and those are what we will focus on here.

If you want to read the full detailed breakdown of the model, you can read the whitepaper:

1) Github: https://github.com/worldwide-asset-exchange/defi

Or the guide on how to add your WAX to the DEFI system:

2) Medium: https://medium.com/wax-io/wax-tokenomics-defi-is-now-live-heres-how-to-participate-ded30c7c4134

When it comes to WAX, we got 3 tokens, ye, told you it would get a bit complicated.

WAXP - The WAX Protocol token, this is the one used on the WAX Blockchain to buy resources, NFTs and so forth.

Then we have 2 DEFI tokens:

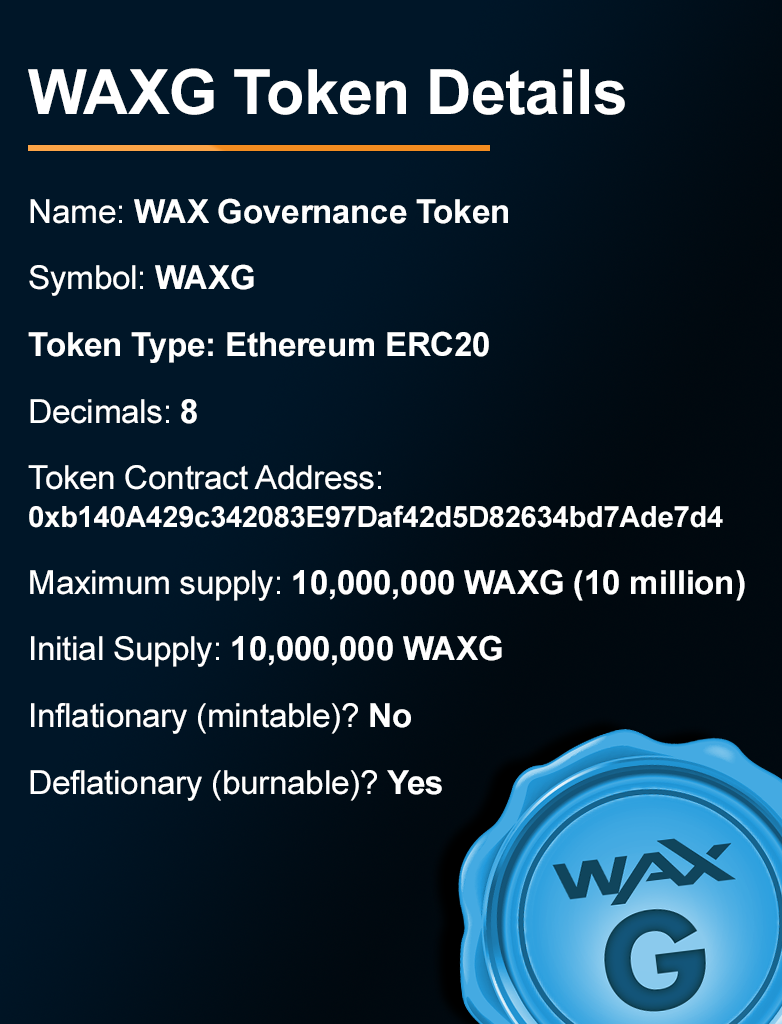

WAXG -The WAX DEFI Governance token, this is used in the DEFI DAO, and is earned through participating in the WAX DEFI model by staking WAXEETH token.. ok, that's a 4th token, we'll get there.

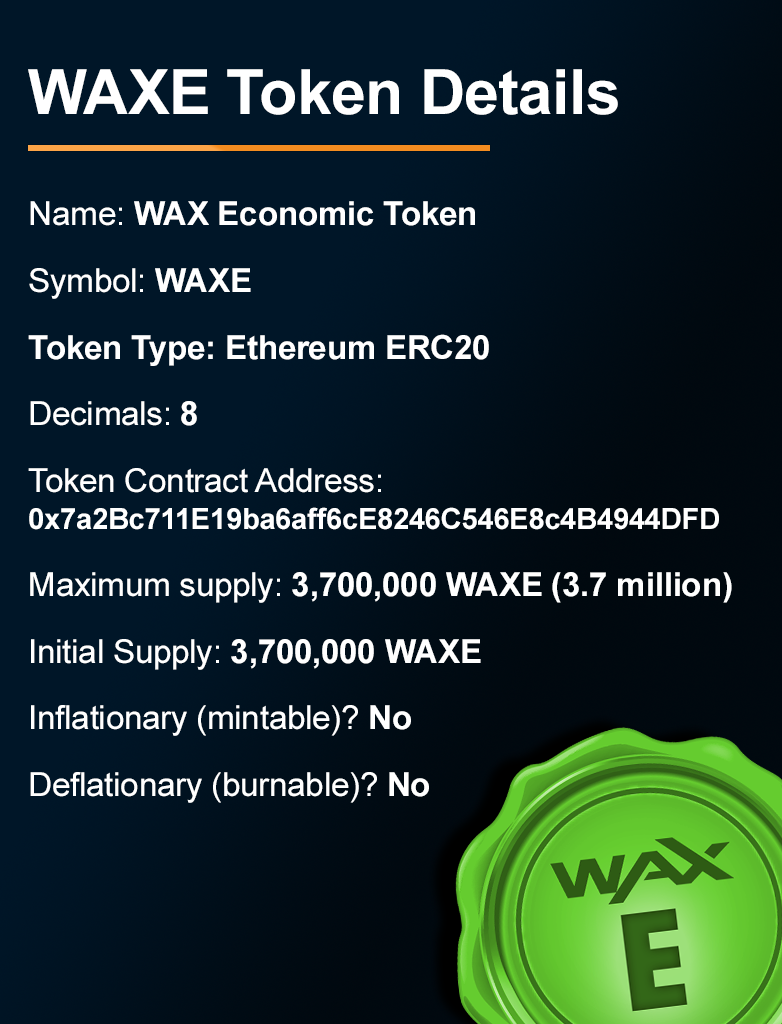

WAXE - The WAX DEFI Economic token, this is the main DEFI token, and is pegged to WAXP 1:1000, so for every 1000 WAXP, there is 1 WAXE. This is the token you can swap to WAXP, or swap to from WAXP, yep, a dual gateway.

Now, the WAXEETH token, is what you get in uniswap when you add WAXE and ETH (ethereum) to the uniswap liquidity pool. This WAXEETH token can then be staked in the WAX DEFI system, and will earn you dividend on ALL NFT volume on the WAX Blockchain. By participating in the WAX DEFI model, you essentially own a part of the WAX NFT Market. sweet, right?

To be exact, 2% of all NFT trade volume is being transferred over to the WAX DEFI system and distributed to stakeholders. At the time of writing this (Jan 2022), the total trade volume on WAX is: 17.7B WAX/$474.5M, Which roughly translates to about $9.49m distributed to the DEFI stake holders so far. Where the big months was the autumn of 2021.

Oh ye, and you actually earn your DEFI rewards in ETH and WAXG by participating, NEAT, right?

WAXE Token Contract Address: 0x7a2Bc711E19ba6aff6cE8246C546E8c4B4944DFD

WAXG Token Contract Address: 0xb140A429c342083E97Daf42d5D82634bd7Ade7d4

WAXEETH Token Contract Address: 0x0ee0cb563a52ae1170ac34fbb94c50e89adde4bd

WAXP ERC20 Token Contract Address: 0x2A79324c19Ef2B89Ea98b23BC669B7E7c9f8A517

Some details on the DEFI model

- Out of all NFT sales on WAX, 2% goes to the WAX DEFI model. Out of those, 80% is distributed to the stake holders, and 20% is being burnt. Which means that the higher NFT trading volume we see on WAX, the more tokens are burnt which will reduce the supply of WAXP.

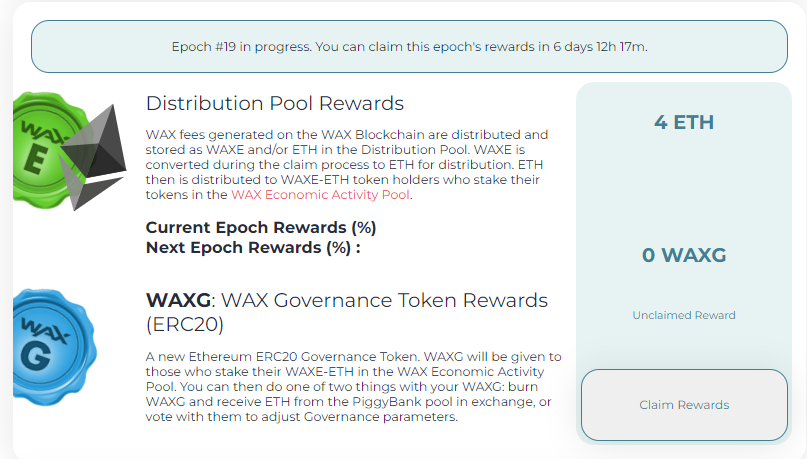

- Payouts to those participating in the DEFI model has to be claimed, you don't have to claim each epoch but can let them stack over time, so don't waste ETH gas fees! You claim them inside your cloud wallet.

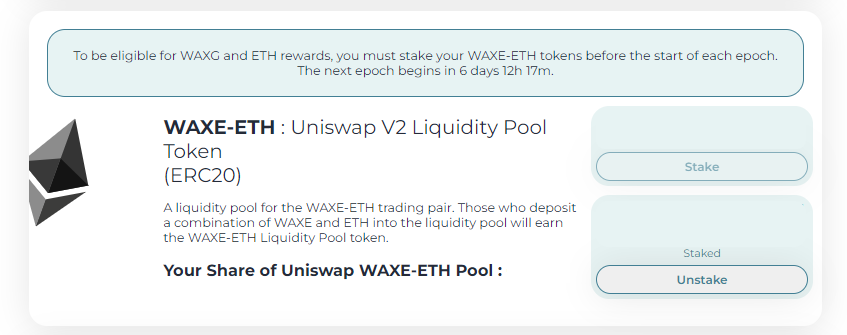

- Each period is called an "epoch" and is 4 weeks, this lenght is to reduce the amount of times WAXP is swapped for ETH and maximize how much you get. So don't worry if you do not see any increase in ETH balance on your account.

- To enter an epoch, you can not join the last day before payout and still get it, but rather, you need to join before an epoch starts. That will allow you to get the payout of the next epoch. This system helps to reduce abuse, by making sure you leave your stake over time. So if you plan to participate, get your stake in before the next epoch starts.

What is required to participate?

To participate in the WAX DEFI ecosystem, you will need 2 wallets.

1) The Cloud Wallet - tbh, this is not required, but it will save you a lot of headache. You can ofcourse interact directly with the smart contracts if you please, but ye... Use the cloud wallet DEFI interface.

2) Metamask - To set up an Ethereum Account, you then need to load it with at least enough ethereum to cover gas fees, and also what you want to add into the uniswap liquidity pool.

Below you will find a video walkthrough of all you need to do to participate, I will also break it down in text and images below so you can follow.

Now, let's participate in the DEFI model!

From here on, I assume you already setup a metamask wallet as well as a cloud wallet. If you have not, check out the tutorial on cloud wallet earlier in this course, and for metamask, when you set it up, make sure your backup your recovery phrases in a SECURE way.

I will also assume you start on WAX, so the first step will be to swap WAXP over to WAXE on Ethereum. You can technically skip this step by buying WAXE directly on uniswap.

Each step will have two gas fees, so stack up your eth.

1) Gas fee to approve the contract

2) Gas fee to do the action

1) Swap WAXP to WAXE

Important notice: each time you swap, it has an individual claim action on Ethereum, so if you swap 10 times, and then want to claim them, you need to pay gas fee for 10 claims. So better wait and do 1 big chunk to save on those pricey gas fees.

Move to: https://wallet.wax.io/eth-bridge

Swap a minimum of 1000 WAXP, and I suggest to do more than that, because if not, the GAS fees on ethereum will eat up your profit margins.

a) Just enter the amount of WAXP you want to swap

b) Hit that Get WAXE

c) Sign it in metamask

d) Enjoy life

Bear in mind, that the transaction time on Ethereum as well as the gas fee may vary.

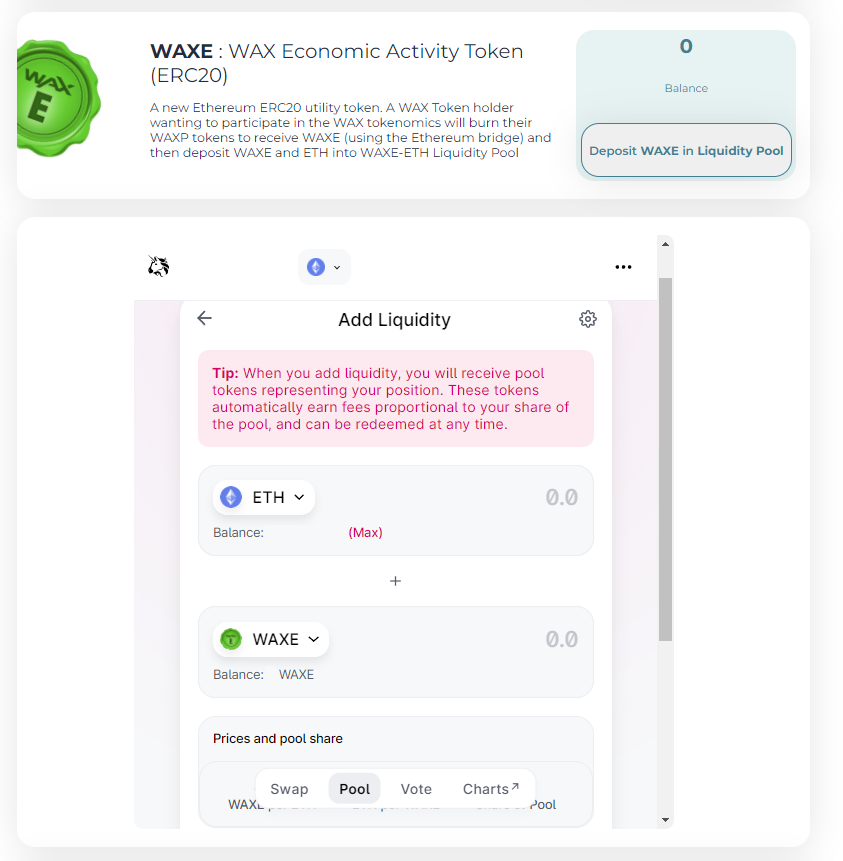

2) Add WAXE & ETH to the Liquiditypool on Uniswap

Move to: https://wallet.wax.io/defi

Now that you got your WAXE over at Ethereum, You can deposit your WAXE & ETH to the liquiditypool.

Now, before we continue, You need to understand that adding anything to a liquidity pool can lead to impermanent Loss. If you do not know what that is, I recommend reading this article on the Binance academy: https://academy.binance.com/en/articles/impermanent-loss-explained. TLDR is that when you unstake your tokens later, you may end up with a different amount of WAXE or ETH than you put in.

a) Add the amount of WAXE you want to stake, and the ETH will be calculated for you.

a2) Incase you don't have enough ETH, you can get some more from an exchange, or swap some WAXE for ETH in the liquidity pool.

b) Approve the uniswap contract

c) Wait until the approval has been confirmed on the blockchain

d) Add your liquidity by approving that action in the metamask wallet.

e) Wait and see if it got approved

f) Enjoy life

3) Stake your WAXEETH token to the DEFI pool

Now that you got the WAXEETH token from providing liquidity in the WAXE & ETH pool on uniswap, you can stake it into the WAX DEFI model.

a) First step will be to approve the defi contract in metamask

b) Wait until it's been fully approved

c) Now you can stake your WAXEETH

d) Sign it in metamask, and wait

e) Enjoy life-long returns on the WAX Mainnet NFT market

4) Claim your eth & WAXG rewards (They stack, no need to claim each time)

Now you got your liquidity, a full epoch has passed, and you are ready to look at your first rewards.

Now, directly inside your cloud wallet, you can check your reward balance, this will stack, so you don't have to claim it now.

Either you wait until gas costs are lower, or you wait until you got a bigger stack of rewards, to reduce the costs and maximize profit.

As with everything on ETH, you will need to approve the contract, and then claim.

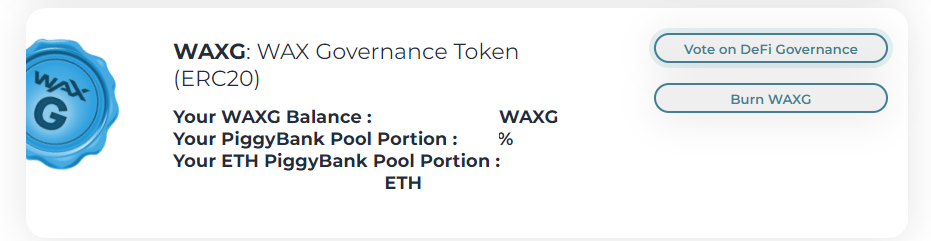

The WAXG token, Let us break down how that works!

First, the Voting for the WAX DEFI Governance will start when more of the WAXG tokens are distributed, this is to reduce the impact of one individual.

Secondly, you will see a word that we have not yet looked at, the PiggyBank. I saved that aspect of the WAX DEFI model until now to reduce complexity, I mean, it's complex enough without it.

The PiggyBank is actually rather straightforward. You remember that out all WAX Trade volume, 2% is going to DEFI, out of those 80% is going to the DEFI model and the other 20% are burned. That means 0.4% equalent of WAXP of all NFT trade volume on WAX are burned, forever. But for the 80% number, the other 1.6% of the total volume, is actually split up into 2 portions.

Portion a) Goes directly to the stake holders of the DEFI model, they call that portion the WEAP.

Portion b) Goes directly to the PiggyBank, initially, this is 50% of all DEFI rewards, meaning 0.8% of all NFT trade volume on WAX.

WEAP actually stands for: WAX Economic Activity Pool

Now, the Piggybank, will ALWAYS grow, well, as long as we have any NFT volume on WAX Mainnet.

Each WAXG represent 1/10,000,000 portion of that piggybank.

Let us say that you have 100,000 WAXG, which is 1% of the entire WAXG supply. That means you own enough WAXG to represent 1% of the total PiggyBank pool.

And since the supply of WAXG is a locked supply, theoretically, your portion of the Piggybank should increase overtime, since the WAXG supply is locked, but the PiggyBank is evergrowing.

In my opinion, the WAXG token, is the most interesting aspect of the WAX DEFI model. You can, at any time, burn your WAXG and get your portion of the PiggyBank in return. But considering this model, are you sure you want to do that now?

Summary

WAX DEFI model consist of the 2% of the total NFT Trade Volume on WAX Mainnet. For those that stake WAXEETH token in the liquiditypool you will receive ETH and WAXG rewards every month. They keep stacking, so you do not need to claim it directly. There are 4 tokens to keep track of, WAXP, WAXE, WAXG and WAXEETH.

To get rewards, you need to enter before a current epoch, once you entered you can just leave the stake there until you don't want to be in it anymore. no need to do any more actions.

You may burn your WAXG at any time for your portion of the PiggyBank, but keep in mind, the PiggyBank is evergrowing, and the total supply of WAXG is capped at 10,000,000.

If you want a deeper breakdown of the DEFI model, you can check out this 90min interview with the Lead Engineer over at WAX.